If you’ve been around stock trading circles, you might have heard the expression “bull market” or “bear market”. It’s common to hear that a stock is bullish or that an industry is bearish.

Simply put, when traders say Bull, Bullish, or Bull Market, they mean stocks are trending upward over time. When traders say Bear, Bearish, or Bear Market, they mean those stocks are trending downward over time. If AMZN is bullish, it’s going up. If the S&P 500 is trending downward, we’re in a bear market. Keep in mind that a symbol might have a bad day and still be considered bullish. It is also important to consider that a symbol can switch from bear to bull at any given time. The key word here is trending- trends can and do change.

Generally speaking, being in a bull market is highly desirable, while the bear market is something to avoid. However, this doesn’t mean that you’re screwed if we enter a bear market- just means you need to know how to play it. More on that later.

If you’re having trouble remembering, think of how these animals act. A bull will charge at the target, while a bear will remain docile unless disturbed (I don’t recommend testing this). In turn, bullish stocks charge at higher prices, while bearish stocks plummet or remain stuck.

How do we know if a stock is bullish or bearish?

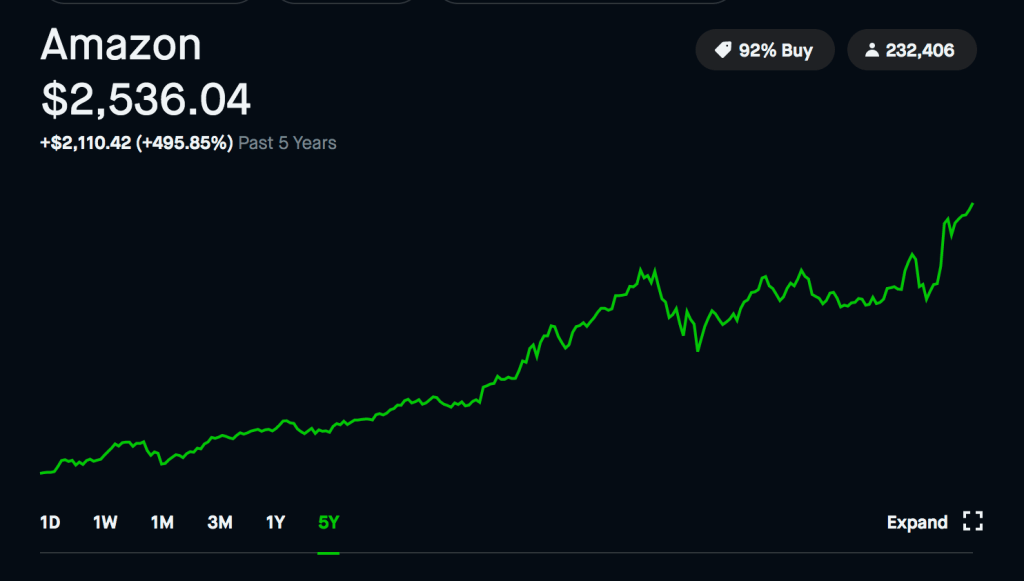

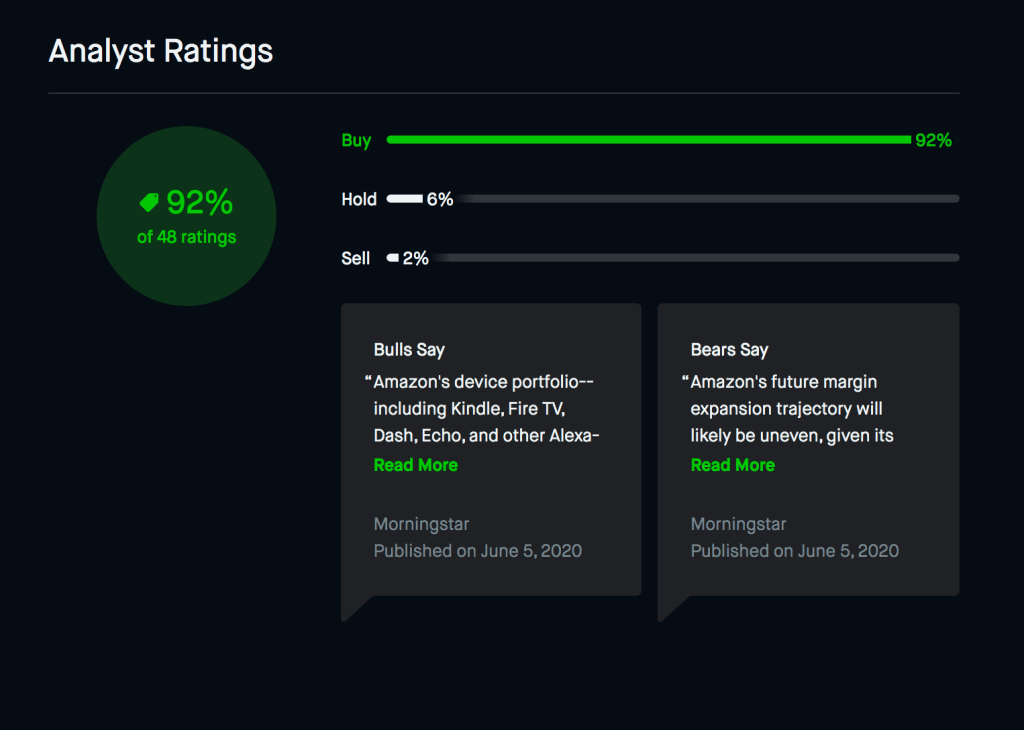

Well, if you’re a beginner trader, there are a couple ways to tell. Let’s begin with a very basic, painless chart analysis. Here’s AMZN (Amazon).

See how it’s a 92% buy rating, it’s got a nice long growth trending upward over a 5y period, and it’s all green? This screams BULL. Let’s go back to that buy rating.

Each stock is assigned a rating ranging from BUY to SELL. We’ll talk more about this at a later date, but it’s a good thing to look at to know if a stock is bullish or bearish. If analysts are saying “buy”, they likely mean “it’s a bull”, because they think it’s trending upward. But here’s the thing- note that there’s a bear opinion on Amazon. Because calling a stock bullish or bearish is subjective, opinion will vary on whether or not a stock will continue to trend in a certain direction.

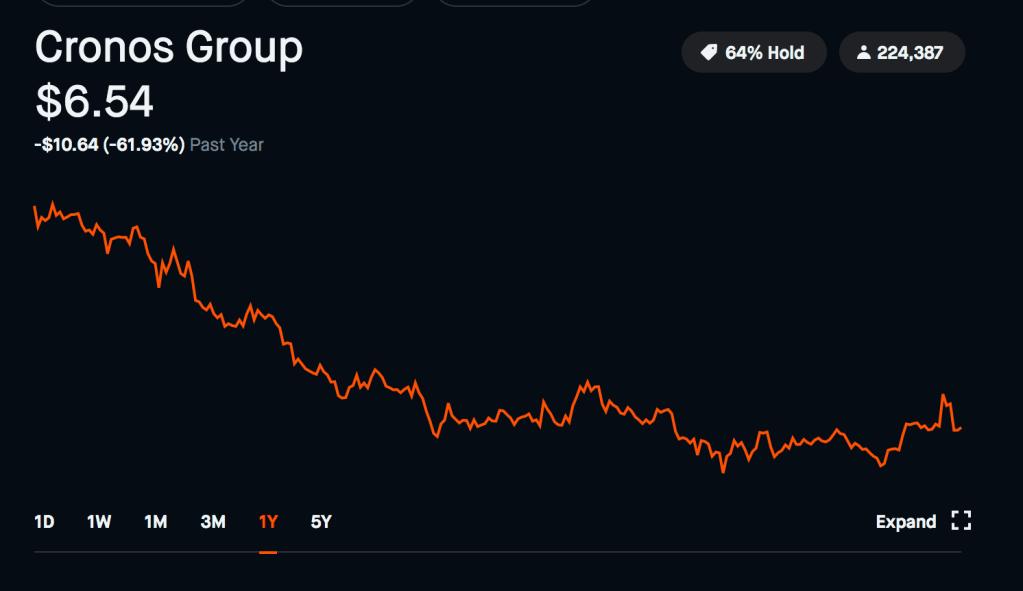

Now let’s take a look at another chart. Here’s a big ol bear.

See how CRON just descends, taking everyone’s hopes and dreams down with it? Do you feel my pain? Do you feel the bear? Terrible. I may have a slight bias.

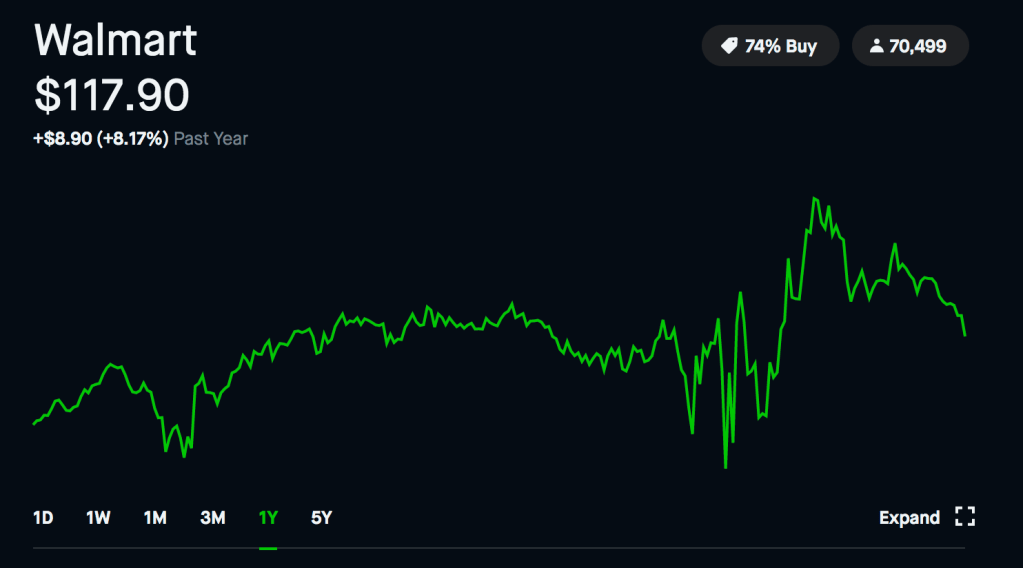

So, we’ve seen clear bulls and bears- but what about this?

If we look at the 1y chart for WMT, it’s slightly bullish. If we look at the 5y chart, it’s definitely bullish. If we look at the 1w chart, it’s bearish. So what is it? It’s whatever you want it to be! It all depends on how long into the future you’re looking. If you’re planning on shorting the stock, it’s a bear. If you’re planning on holding that baby, it’s a bull.

Got it? Great.

So what do we do with this information?

Bear means BUY! Bull means sell, or… well, actually it’s complicated. If stocks were that cut and dry, everyone would be a millionaire.

Because I’ve written this with the assumption that you’re an absolute beginner, I’m going to recommend that you treat stocks as a long term place to grow your cash. With that in mind, try to pick bullish stocks on a slight dip to buy, with the hope that they’ll continue to go up. The best time to buy is yesterday, so hop on that!

If you trade options, this bit of information is for you. If you don’t trade options, don’t start trading options, skip this because it probably won’t make much sense to you anyway and again, don’t start trading options. Anyway, for all you awful options traders out there- if you believe a stock will become bullish or bearish, you can put your money where your mouth is. Buy puts for bears and calls for bulls. Straddle or strangle if you think it’s going to swing in a direction but don’t know which one.

Bonus: I’ve heard the term Kangaroo Market in some circles. Please don’t say this, as nobody will take you seriously, but it means that the stocks go up and down wildly over time, resembling a zigzag pattern.

![What do Bulls and Bears Mean in the Stock Market? [Explanation]](https://i0.wp.com/punkstocks.com/wp-content/uploads/2020/06/screen-shot-2020-06-12-at-11.21.57-pm.png?resize=1400%2C794&ssl=1)

Leave a comment